The prevailing sentiment among the people I speak to (predominantly hedge fund managers) is to sell this rally. The reasons given are (also see below for a complete list): 1) One CPI is unlikely to change the Fed’s interest rate trajectory (basically we are data dependent), 2) China has not changed its zero-Covid strategy in earnest, 3) There is still a risk of a winter energy crisis in Europe, 4) JPY weakness will not reverse before YCC is over.

All these are valid, but I will stick with a risk-on attitude a bit longer. In any case, what caused this drastic change in sentiment?

Positioning was really lopsided. See this article citing research from GS which believes CTAs were forced to buy $150Bn in equities and $75Bn in bonds. Real money is also very light risk after being forced to reduce exposures throughout the year. But what were the main drivers which changed sentiment to begin with?

It was weird to see markets actually not really selling off after Powell’s hawkish FOMC press conference. Perhaps the fact that we had a bunch of FOMC members (see here and here, for example), calling for a slowing down of the pace of Fed Fund Rate (FFR) increases, may explain to some extent the positive reaction at the time. And of course, the catalyst came when the US CPI was released lower than expected.

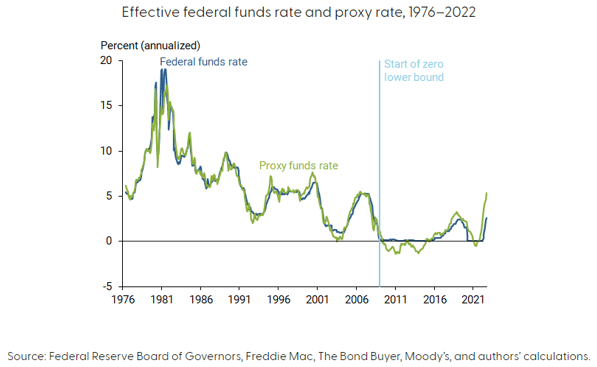

FFR actually does not give anymore a precise indication of the stance of US monetary policy – this is the conclusion of a new paper by FRBSF. If all data such as forward guidance and central bank balances sheet effect are taken into account, the FFR is more likely already above 6% vs the current target of 3.75-4% (the paper puts the FFR at 5.25% for September and I add the 75 bps of hikes since then).

This means monetary policy today is even more restrictive than at the peak before the 2008 financial crisis and approaching levels last seen during the tech bust in 2000. The findings in the paper make intuitive sense. Quoting from the paper:

“[W]hen only one tool was being used before the 200s, the stance of monetary policy was directly related to the federal funds rate. However, the use of additional tools and increased policy transparency by FOMC participants has made it more complicated to measure the stance of policy.”

The new tools the authors refer to are mainly forward guidance, which started to be actively used after 2003, and central bank balance sheet management, which started after 2008. The proxy FFR (see chart above) actually includes a lot more, a total of 12 market variables, including UST yields, mortgage rates, borrowing spreads, etc. It is perhaps intuitively easier to see that monetary policy was much looser at times when the FFR was at the zero-low bound and QE was in full use than it is a lot tighter today when FFR is firmly in positive territory and QT is in order, but the logic is the same.

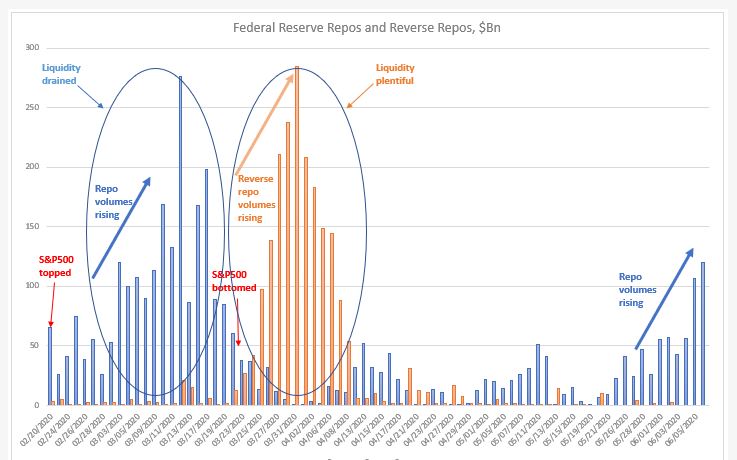

So, I think somehow or other, the market now believes that we have seen the peak in FFR (forward) – that provided the foundation of the risk bounce.

China provided the other pillar of support for risk. Ironically, in a similar fashion to how it played out after FOMC, i.e., the consensus was that the 20th CCP Politburo meeting was an overwhelming negative for Chinses assets. And even though they sold off, there was no immediate follow through. In fact, we started hearing that Chinese authorities are looking into taking the first steps to pivot from the Zero-Covid policy, and are very serious about providing a floor for property prices. Finally, there was a genuine improvement on the US-China relations side as US regulators finished their inspection of Chinese companies in HK ahead of schedule and US President Biden and Chinese leader Xi Jinping met at the Group of 20 summit in Bali.

The third pillar of support came from Europe. First, European energy prices (see a chart of TTF) have come a long way down from their peak in the summer (almost full inventories and mild weather helped). Second, the UK pension crisis was short-lived after the change in government and did not have any spill-over effects on other markets. And third, there is genuine hope of a negotiated solution of the war in Ukraine after the Ukrainian army made some sizable advances in reclaiming back lost territory, with both the US and Russia urging now for possible talks. My personal view is that the quick withdrawal of Russia from these territories is a deliberate act to incentivize Ukraine to come to the negotiating table – even though the latter does not seem eager too . Yesterday’s missile incident, and Ukraine’s quick claim that it is Russia’s fault, which is contrary to what preliminary investigation has led to so far, might be a testament to that.

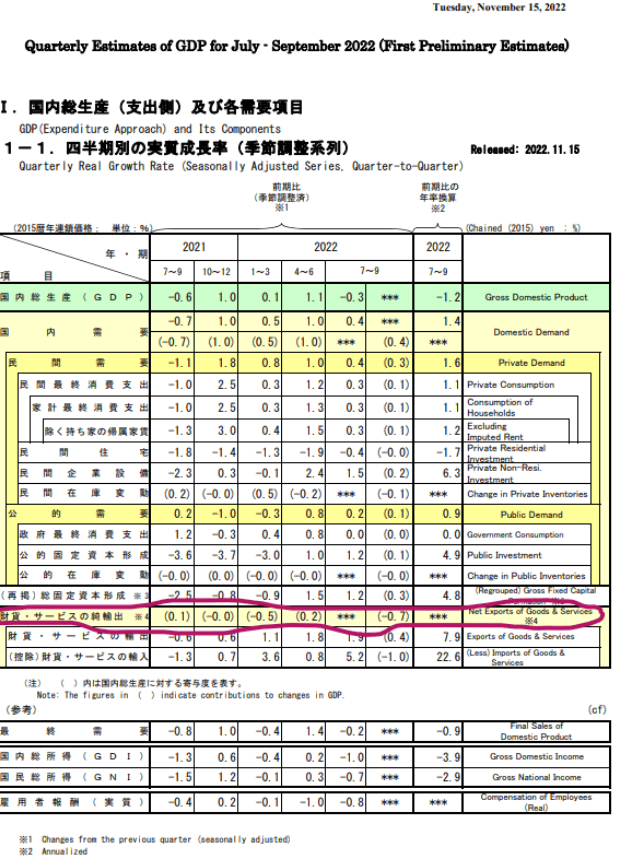

Finally, and that falls under positioning, there is the unwind of USDJPY longs spurred by heavy intervention by Japanese authorities. If there is any proof that policy makers are taking the plunge in the Yen seriously it is in the details of Japan’s Q3 GDP which shrunk unexpectedly by 1.2% (consensus was for a 1.2% increase). The bad news came almost entirely from the negative contribution of net trade. Net trade has been a drag on GDP for the last four quarters primarily from the rise in imports, i.e., the weakness in the Yen. The good news is that the economy otherwise is doing fine: private demand had a big bounce from the previous quarter and has been a net positive overall (all data can be found here): in other words, the problem is the Yen, and YCC makes that worse.

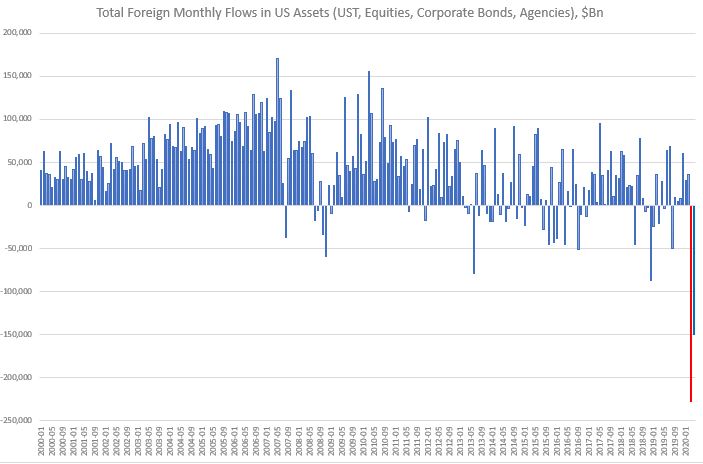

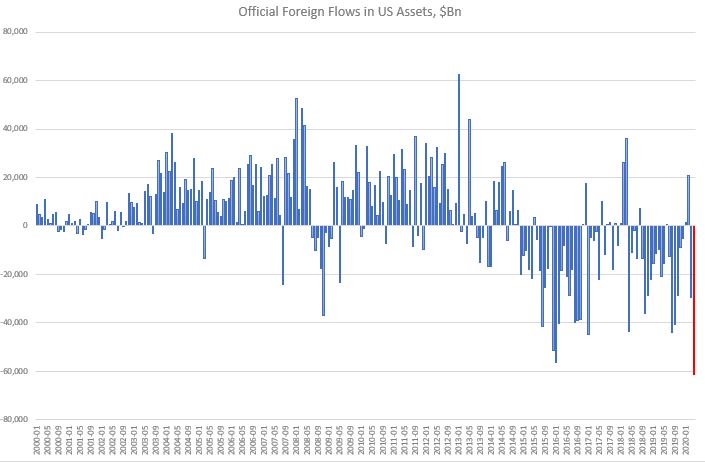

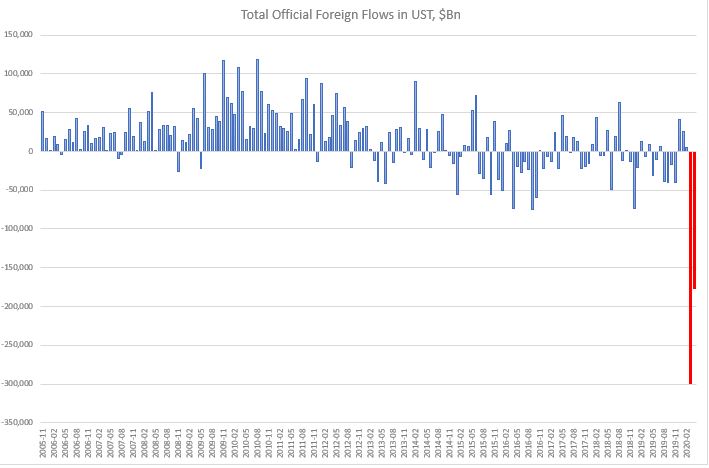

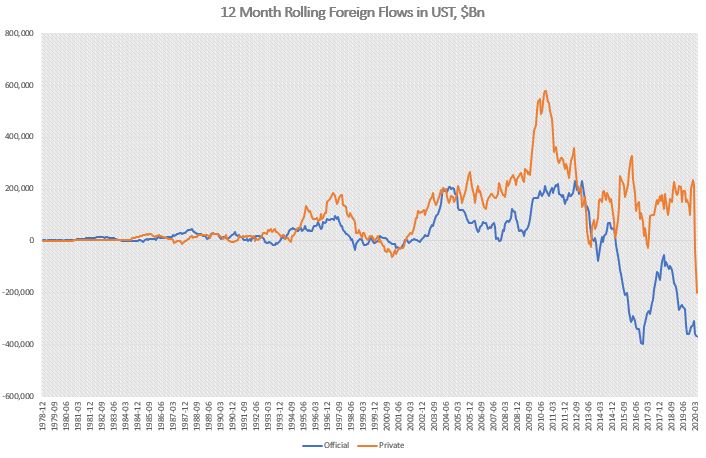

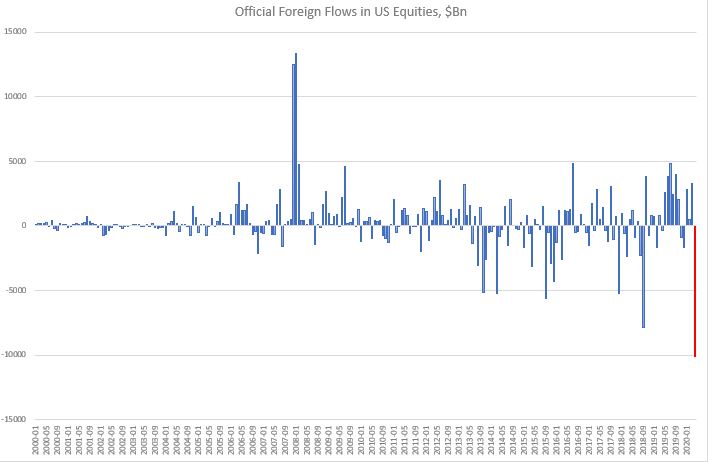

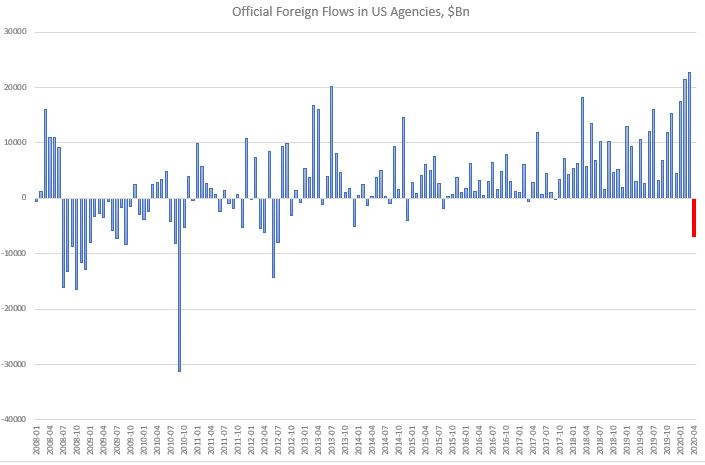

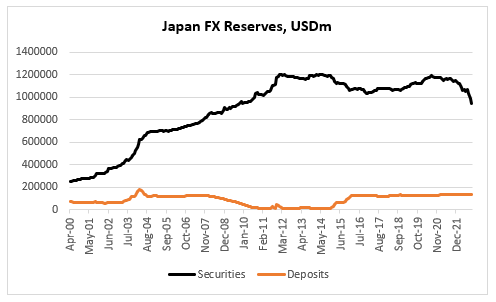

Another piece of data, released last week, which caught our attention, is Japan FX Reserves. The decline from the high in July 2020 is $241Bn, about 18% – that is a substantial amount. The interesting thing, and we kind of know this from the TIC data is that the decline is coming entirely from the sale of foreign securities; deposits actually went up marginally (some of the decline is also valuation). But we know now that when Japan was intervening in USDJPY in September/October, it was selling securities, not depos – most analysts thought Japan would first reduce depos, while intervening, before selling their security portfolio. All data is here.

In summary, CTAs’ sizable wrong way bets long USD and short equities and bonds and real money light risk exposure overall coincided with dovish economic data, reopening China and improving geopolitics (all of these happening on the margin).