This is a follow-up on “’Mining’ for money is a ridiculous idea”

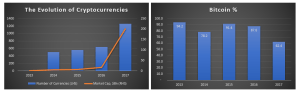

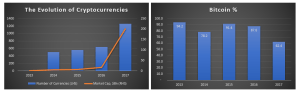

Source: https://coinmarketcap.com/ , Author’s calculations

Summary: By creating private alternative money supply and payment systems, cryptocurrencies are threatening the raison d’etre of both the central bank, which governs the current monetary transmission process, and the private money institutions, which create the majority of the money. This is a dangerous precedent which history shows does not end well for the incumbents. Bitcoin, specifically, while it has developed an ingenious way of money creation through the blockchain, has unfortunately, other flaws, namely fixed end supply, high energy costs, limitations of the number of transactions it can process, security and privacy risks.

A ‘bubble’ is a dangerous thing to play with

Below, I am questioning in theory the rise in Bitcoin’s price, specifically, but also the viability of all cryptocurrencies. However, I am absolutely not doing anything about it in practice. Even though the sudden increase in cryptocurrencies’ market capitalization looks absolutely ridiculous to me, I have been around the markets long enough to have been burnt by the Siren call of shorting a bubble before it is ready to pop. I do not have positions in any cryptocurrencies, nor am I advocating positions in any at this point.

Even in real life, I hate the bubbles equivalents: the balloons. They make me nervous because of the uncertainty and suddenness of that popping sound whenever the balloon touches something sharp eventually. When my kids were little and they were invited to a birthday party, I always tried to find an excuse not to go: it was inevitable that balloons would be popping up. The funny thing is that when they brought a balloon home, left it somewhere in a corner and forgot about it, I had no problem: I knew, sooner or later, that the balloon would naturally deflate.

Being right vs. making money

So, I was never a bubble chaser when I was a trader. I preferred to make the money on the way down, after the sudden pop or even when the bubble slowly filtered away. 2008 was my best year, but not because I predicted the crisis. Not at all. I mean, in the years preceding the crisis EVERYBODY knew that credit spreads were ridiculously tight, that the US consumer had too much debt, etc. But nobody, that I know, had the bearish trade on when the bubble eventually burst in 2008. I remember though trying (to put it on) – buying protection in a number of US and UK banks and especially in Eastern European sovereigns – but it was always too early and the negative carry eventually made the trade not worthy.

Going into 2008 I was at least not long the market. By the end of that summer, my P&L was chopping around 0 (but more often on the negative side): the shorts did not work out, and I did not have the stomach to be long. It was basically a waste of time. In fact, I was convinced that they would not let Lehman go. I mean, they had ‘saved’ Bear Stearns…But, moreover, I had done my homework and was aware that Lehman was probably the main character in the shadow banking game. You take Lehman out and the whole show is over: a run on the banks. But not from the retail depositors side – the broker/dealers (Morgan Stanley, Goldman Sachs) did not have retail depositors – rather from the institutional side. I knew that the shadow banking system had produced the majority of the monetary liquidity and that once it was blown apart, the central bank would have to step in big time.

I think if you were in the markets back then, you would always remember exactly what you were doing when you first found out that Lehman Brothers declared bankruptcy. The importance of the event was enormous even by itself: a venerable institution, more than 150-years old, which survived even the Great Depression. (I think the equivalent of that would have been the collapse of Barring Brothers, the second oldest merchant bank in the world, in 1995. Sadly, I started my career on Wall Street in 1996 and have no recollection of that event). However, that Sunday, September 7, 2008, I was waiting to board a flight from Venice to London – we had been there to attend a relative’s wedding. Checking my Blackberry, I was stunned when I read the news! What followed in the weeks after was a relentless buying of Eurodollar futures contracts (short-term rates, not the currency for those that may be confused here by the terminology). And that is why 2008 was my best year managing money…

2008 was year zero in modern banking

While I seemed to be on top of the (trading) world back then, for all intends and purposes, 2008 could be considered the end of traditional banking. The big deal in that sense, however, and in hindsight (always in hindsight – hindsight is the best friend we have ever known) was not Lehman’s bankruptcy, but a white paper by a person or an organization by the name of Satoshi Nakamoto. The paper came in late October of that year. I said in hindsight because I did not know about the paper until much later (and anyway, I was too busy trading Eurodollar futures contracts in 2008). It was the creation of Bitcoin and, more importantly the process associated with it, the Blockchain, which would mark the year 2008 for me: the time before that would be considered BB (Before Blockchain), and the time after – AB (After Blockchain)!

In fact, I do not remember when I first found out what Bitcoin is: 2011, 2012? Yes, I think it was in the midst of the Greek debt crisis when Bitcoin appeared on my trading horizon. You see, I love the idea of technology but I am absolutely rubbish when it comes to its practicality. Bitcoin first became a hot topic of conversation simply because we were in the midst of the European crisis, gold had more than doubled up since the 2008 crisis, interest rates were at 0%, and some smart people started to look for an alternative safe haven for personal use. (Not me…)

However, I never really got involved until late 2015 when I wrote a paper on the Blockchain. I remember when I first mentioned ‘blockchain’ in one of our regular office meetings. Literally no one had a clue what I was talking about. People had kind of heard of bitcoin, but not of blockchain. In banking circles, at least, the idea of the bitcoin was a complete anathema back then. No one of any reputation wanted his or her name associated with ‘Bitcoin’. And rightly so, because it was thought the ‘currency’ was used for nefarious deals on the dark net (and it probably was). Plus, a number of exchanges dealing with it had gone bust in mysterious circumstances.

Anyway, that paper was not on the bitcoin but on the blockchain. We explored how central banks can take the idea of the blockchain from the private sector and use it in a novel way to collect and analyze economic data which would help them conduct monetary policy in a much more efficient way. We advocated a sort of 100% reserve banking experiment.

Since the breakdown of the Bretton Woods System in 1971 and probably by the early 2000s, the private banks had done a fairly good job (with the use of the credit intermediation process) of creating just enough money supply to, more or less, match economic activity (MxV=PxT). However, as our economies gradually moved in the digital era, it became increasingly more difficult to capture that economic activity and match it up with enough mediums of exchange: in a sense, my position was, and still is, that because of its inherent lack of knowledge of economic activity our current monetary system does not produce enough money in order for the economy to work at its full potential.

GDP accounting, created in the ashes of the Great Depression, was more suited to an industrial economy, not so much to a service or, let alone, a digital version. The money created by the private banks, therefore, became increasingly more detached from the real economy. After the burst of the consumer debt bubble in 2008, there was very little demand for loans, so the banks could not create money even when it was most necessary. In addition, the increase in banking capital requirements thereafter, made it more difficult to extend loans and create money even if there was demand for that from the public or corporates.

Basically, it was a mess. Money supply had stopped working properly. So, we thought, what if the primary creation of the money went back to the state. The elegance of the blockchain process allowed for a decentralized, distributed ledger of (economic) data (the new GDP) which the central bank could use to govern the creation of money. This new technology provided for a big diversion from the old days when the state would misuse the creation of money (and which gave ‘helicopter money’ their bad rap).

In a sense, the blockchain offered a sensible alternative to the private-banks-run credit creation of money. In our example, however, the private banks would continue to create money but they would be constrained by a version of ‘100% reserve banking’. The blockchain, therefore, would allow the issuance of central bank digital currency (CBDC) accessible to the public at large (as opposed to a small number of depositor-taking institutions).

Central Bank Digital Currency

That was 2015. At that time, only Ecuador had begun experimenting with CBDC. Eventually, Ecuador became the first country to introduce its own digital cash after it had banned Bitcoin. “Electronic money will work as a payment method beyond the legal tender in circulation, and used with absolute trust by the entire citizenry…”(Source: Electronic Money, Banco Central del Ecuador).

Since then, pretty much all major central banks have embarked on the road of evaluating the feasibility of CBDC. None has, so far, done it.

In its One Bank Research Agenda (OBRA) from February 2015, the Bank of England posed the question of whether central banks should issue digital currencies. “Digital currencies, potentially combined with mobile technology, may reshape the mechanisms for making secure payments, allowing transactions to be made directly between participants. This has potentially profound implications for a financial system whose payments mechanism depends on bank deposits that need to be created through credit.” Since then the BoE has issued several papers on the viability of central bank digital currency. It is also partnering with UCL to practically explore the possibility of creating the so-called RSCoin.

The Riskbank (Sweden) is the oldest central bank in the world, the first to issue paper money in the 17th century, and the first one to move to negative interest rates. It could also be the first to issue CBDC. “The Riksbank is investigating whether it would be possible to issue a digital complement to cash, so-called e-kronas, and whether such a complement could support the Riksbank in the task of promoting a safe and efficient payment system.”

Already in 2014, Danmarks National Bank (Denmark’s Central Bank) said that bitcoin is not money and [Bitcoins] ‘have no actual utility value, bearing closer resemblance to glass beads’. However, blockchain technology, or a variety of that, for example, would be an obvious model to use of virtual currency.

Canada’s Central Bank is running ‘Project Jasper’ which examines the feasibility of using distributed ledger technology (DLT), aka blockchain, to construct a wholesale payment system. This could eventually lead to the central bank issuing a digital currency of its own, called Cad-coin.

The Monetary Authority of Singapore (MAS) is running Project Ubin which uses DLT for inter-bank payments. In a speech (“Economic Possibilities of the Blockchain Technology”) at the Global Blockchain Business Conference this October, Mr. Ravi Menon, Managing Director of MAS asked: “…can we create a more efficient inter-bank payment and settlement system without MAS acting as the trusted party?”

The Central Bank of China could be considering the issuance of CBDC as a way to stabilize its own fiat currency while expressing concern of the inherent dangers of crypto currencies. According to this report, Yao Qian, the Director of the Digital Currency Institute under PBOC said, “it would be a disaster to recognize it [Bitcoin] as a real currency. And the lack of value anchoring inherently determines that bitcoin can never be a real one.”

Heavily burnt by the 2008 financial crisis, Iceland may be taking the most direct drastic measures. In a report commissioned by the Prime Minister, the suggestion is: “[I]n a Sovereign Money system, private banks do not create money. Instead this power is in the hands of the Central Bank, which is tasked with working in the interest of the economy and society as a whole. In the Sovereign Money system, all money, whether physical or electronic, is created by the Central Bank.”

In January 2017, the Reserve Bank of India (RBI) issued a white paper recommending the adoption of the blockchain. In September 2017, IDBRT, a research institute established by the RBI, announced plans for the launch of a blockchain platform.

The Central Bank of Russia (CBR) is moving fast towards the development of a national digital currency. In October 2016, CBR announced it had successfully developed a prototype blockchain called “Masterchain”.

In November 2016, Hong Kong Monetary Authority (HKMA) issued a white paper on the advantages and disadvantages of DLT. In October this year it issued a second white paper in which it stated clearly, “[A]part from the PoC projects, the HKMA has also commenced research on Central Bank Digital Currency (CBDC) with the aim of assessing the potential benefits, challenges and future implications of issuing CBDC. This is another example of the growing potential for the application of DLT.”

The European Central Bank (ECB) has issued several papers on DLT and its potential (the latest) without being explicit about the use of blockchain-based CBDC. Indeed, both the ECB and the Bank of Japan have said recently that they think “DLT like blockchain is not mature enough to power the world’s biggest payment systems, though it has the potential to improve system resilience”. However, Japan’s Financial Service Agency is developing a blockchain-powered platform that will enable Japanese consumers to instantly share their personal information at multiple banks and financial institutions.

Finally, the US Federal Reserve issued a white paper on the possible use of DLT in payments, clearing and settlement. However, recently elected new Fed Chairman Powel said in a speech in March this year, referring to the potential use of DLT or other technologies by central banks to issue a digital currency to the general public, that “[W]hile this is a fascinating idea, there are significant policy issues that need to be analyzed.”

The proliferation of cryptocurrencies

In a sense the developments described above stemmed from the period of central bank uncertainty post 2008. The uncertainty arose not because the central banks were not transparent enough (in fact, one could argue, they were too transparent), but because the policies they were adopting were unprecedented in modern times (post 1971). In addition, it was also a result of the advances in technology which allowed for a potential revamp of the money creation and transmission process. This naturally raised the issue of trust which, coupled with the lack of sufficient money circulation in the real economy, provided for a fertile ground for the development of a decentralized, distributed ledger-based cryptocurrencies that also offered a level of digital security never seen before.

In 2013 there were just 7 alternative digital currencies with a market cap of about $1.5Bn. Bitcoin was the largest amongst them (see Charts at the top). By October 2017, the number of crypto currencies had risen to 1260 and their market cap to $201Bn. Bitcoin is still the largest but its share has fallen from 94% to 62%. However, the top three cryptocurrencies (Bitcoin, Ethereum and Ripple) still comprise 85% of the total market cap.

The proliferation of these private cryptocurrencies fills a void in the money supply which the central banks have not been able to fill despite the massive increase in their own digital reserves (i.e. the central bank balance sheets). The economy is lacking a medium of exchange (and the subsequent unit of account) in order to operate at its optimum level. The traditional income distribution model, Work=Job=Income, which has characterized the industrial economy so far, stopped working sometimes in the early 1980s with manufacturing finally giving way to services.

In the late 1990s, as the digital economy started gaining speed, consumers started making up for their lost income with debt ‘secured’ by real estate and engineered in the so-called shadow banking system: private ‘AAA-rated’ subprime mortgage pools acted as ‘mediums of exchange’ in a not-so-dissimilar manner to today’s cryptocurrencies. The end of the debt super cycle in 2008 put a stop to that, and with the central banks unable to do anything about it, cryptocurrencies came to the fore.

Despite the massive rise in cryptocurrencies’ market capitalization, they are still less than 1/6 of the subprime total market capitalization at the peak of the crisis in 2007. One could say that they are not, yet, in any way, shape, or form of a systematic significance to the financial system. The problem is that at the growth rate the cryptocurrencies’ market cap is rising, it will reach that critical level ($1.3Tn for subprime) in a couple of years or so. So, perhaps, we may be in 2005 or 2006 equivalent to the 2008 financial crisis?

In addition, however, there is the further danger that crypto currencies are a much more direct competitor to central bank legal tender than shadow banking money because of the ease at which they can be accepted as medium of exchange and unit of accounts in retail outlets. As more economic transactions go through private digital currencies, central bank monetary policy could become less relevant. If there is less need for final settlement in central bank reserves, this threatens the whole existence of the central bank. In addition, if the crypto currencies do not use the private banking system for payments, what is the role of the private banks?

Bitcoin’s major flaws

There is a lot of stake to the current monetary transmission mechanism and it is for this reason why the central banks are starting to react (see above). If history is any guide, they will not hesitate to outlaw any attempt which is aimed at taking over their privilege to govern the money creation process. But Bitcoin also has numerous flaws on its own (the below written from a non-technical, but rather functional, point of view as it pertains specifically to money creation and transmission).

Store of value vs medium of exchange and unit of account. Bitcoin is trying to be both as seen by the various jurisdictions coming with different classifications for it (asset vs currency). But NOTHING can be all these things together at the same time and to the same extent. Bitcoin is a store of value first and a medium of exchange/unit of account second. That is a is problem if it is trying to be a currency. For, if a currency is expected to increase in value it is much more likely to be hoarded than exchanged and thus it is very unlikely to ever become a unit of account. A normal currency’s value is a derivative of its medium of exchange/unit of account function, not the other way around as in the case of Bitcoin.

If Bitcoin, on the other hand, is an asset, then it cannot expect to be a medium of account and unit of exchange in the real economy. However, that puts into question the source of its value in the first place. Compare to gold which, similarly to Bitcoin, has been used as a store of value for centuries due to its pureness (difficult to forge), malleability (ease to transport) and scarcity (limited additional supply). But at least, when all else fails we use gold for decorations. In addition, and more importantly, the authorities gave a big stamp of approval to gold by using it as the core of their money creation process. And when they did not, they did not like us to do it either (confiscation of gold during the Great Depression).

Fixed-end supply. A total of 21m bitcoin can be created. Unless the protocol is changed, the last bitcoin will be “mined” in 2040. Moreover, the rate of bitcoin supply gradually decreases each year (current inflation rate of bitcoin supply is around 4%). By some estimates already 3 out of every 4 bitcoins ever to be created are already ‘mined’. Needless to say, that is why Bitcoin is considered valuable.

But as seen in the preceding paragraphs, if this also destroys the purpose of bitcoin’s use (and assuming there are no other reasons why anybody would want to hold bitcoins), then it also degrades its value. The actual supply of bitcoin can be both much smaller than 21m (miner underplay and other technical peculiarities, loss/destruction of bitcoins) and larger (protocol is changed or the idea of ‘fractional reserve bit-coining’ is practiced).

High energy costs. I already touched on this issue here. More knowledgeable people have written extensively on the technicalities of energy usage in bitcoin ‘mining’ (see, for example, this, “One bitcoin transaction uses as much energy as your house in a week”) so I am not going to spend more time on this.

Transaction processing speed. Bitcoin’s blockchain can process low single digits to low double digits transactions per second. This is much lower compared to traditional payment system providers (Visa, MasterCard, PayPal, etc.) which can process thousands of transactions per second. There is thus a big question to the scalability of the bitcoin as a medium of exchange in the payment mechanism.

Of course, as the technology advances, more progress is expected in this regard (for example, see “Bitcoin Lightening Network: Scalable Off-Chain Instant Payments”, J. Poon, T. Dryja, January 2016). However, the speed of processing, the energy usage and the security (see below) can be increased several-fold if the blockchain process is designed to be ‘permissioned’ (Bitcoin is ‘permission-less’) as in when governed by a central bank, for example, in the case of CBDC.

Security and privacy risk. Without a ‘central authority of last resort’, there is a bigger risk of losing bitcoins than cash deposits, for example. If you lose your private key, or the hard drive gets corrupted, there is no one you can turn to help you retrieve your bitcoins (this is the equivalent of losing your physical cash). The same holds true for the possibility of reversing a bitcoin transaction, if, for example, it is done by mistake – it is not possible (there is a technical solution called ‘multiverse transactions’ but it cannot be done in a decentralized system like the blockchain as it involves a third party).

In addition, it is possible in theory for a major ‘miner’ with enough computational power to ‘fork’ the bitcoin blockchain for his/her own gain. This also opens up the system for potential fraud by altering past records. If the blockchain is permission-less, as in the case of Bitcoin, nothing stops a ‘miner’ to eventually gain this computational power (including collusions amongst miners – how many people trading currently bitcoin, for example, can understand exactly the permutations behind the most recent fork in the Bitcoin blockchain and why really this was done).

Finally, there is also the issue of hacking, whether the bitcoin is stored in an e-wallet on the internet, or with a centralized exchange, it does not matter (understanding the security of a physical bank is one thing; getting your head around cybersecurity is totally another).

Conclusion: Bitcoin and all other cryptocurrencies are a natural development of the money creation process. They are a result of the free market’s response to the breakdown of the traditional income generation model, which had been in existence since the Industrial Revolution, and the authorities’ inability, or rather, refusal, to address it by creating additional mediums of exchange and distributing them among the population.

The cryptocurrencies, however, are an imperfect solution, at best, to our money problem. Taken to the extreme, they could threaten the existence of the central bank and the banking model, in general. However, the technology inherent in them, the blockchain, used in accordance to the regulatory framework of a central bank and without much change to the current banking system, could shape the new money system which fits better our modern digital economy.