Tags

After a nearly two-year hiatus due to compliance requirements (I was consulting a hedge fund start-up), I will attempt to continue writing on this blog in a more frequent format until further notice.

The Apple of my eye

One of the most enduring questions I have encountered lately is, “How come Apple is still ‘standing’ when not only other big techs are falling apart but also given that Apple is one of the most heavily exposed, amongst them, on China?”. The best answer to this was given this week by Scott Galloway here.

At the core of Apple’s recent outperformance (the stock is down only 20% from peak vs 40-50% for the other big tech and even more for the smaller tech) is a decision the company made a year ago to the effect that the upgraded Apple iOS “forced apps, including Facebook… to ask users for permission to track their data”. Here is the story on this from October 22, 2021.

As it turns out, only about 16% of users agree to such tracking which is a big problem for companies using sophisticated data to direct ads to potential customers. As Prof. Galloway succinctly says in his note, ”[W]ithout data, the digital ad ecosystem doesn’t work”.

Here is a chart of Meta’s global ad revenue growth rates YoY until 2021. Unfortunately, in Q3’22 the company reported its first ever annual decline on a quarterly basis in ad revenues ever. Needless to say, when ad revenues make up more than 95% of the total, this development is a big problem going forward.

What about Apple? The company’s share price performance is perhaps a better indication of the drawdown one would expect stemming from all macro forces for a leading monopoly-like big tech. Yet, its overreliance on revenues from Greater China and Europe (the two combined are bigger than revenues from Americas), two regions which are grappling with idiosyncratic issues such as zero-Covid and an energy-crisis, is probably a reason to be cautions on the stock, nevertheless.

Alibaba and the 40 risks

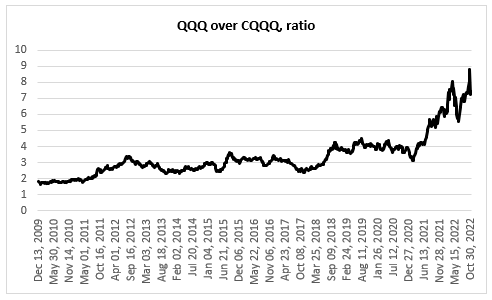

China tech (CQQQ) trades at a record ‘discount’ to US tech (QQQ): the underperformance of the former from a year ago is staggering.

This underperformance is primarily due to regulatory issues which first started in the beginning of 2021 in China. Then at the end of that same year, US regulators independently added further pressure on Chinese companies listed on US bourses. Some of the big China tech ADRs, like Alibaba, are not only trading below IPO price, but also are down 80% from their highs.

I have no idea where this is going to end. However, I do believe that there is legitimate progress in easing of the regulatory burden from both the Chinese side as well as the US one. In any case, given that Chinese ADR positioning is now much cleaner, the regulatory risk from the US side can be easily avoided if one buys the HK-listed shares. I do not know if this is the right time to do that, but I do know that, given their extreme undervaluation, it makes little sense to sell Chinese tech stocks on the risk of a continuation of the zero-Covid policy.

On the other hand, a China pivot on this policy would provide a massive boost to their share prices. From such an angle, the risk-return profile favours some exposure to HK-listed China tech. Still, for any investor in China, the risk of an (almost) ‘total ruin’ is quite real in the extreme scenario of a China-Taiwan conflict which leads to the freezing of Chinese external assets as well as closing access for foreigners to China/HK-listed company shares – something akin to what happened in Russia.

Ultimately, it is this unquantifiable risk which probably holds foreign investors off from dipping their feet in the China market. But, as always, the risk to any trade is not in whether one has the exposure or not, but rather what size it is and how it is timed.