“For a little reflection will show what enormous social changes would result from a gradual disappearance of a rate of return on accumulated wealth.”

~ John Maynard Keynes

Lately, not a day passes by without someone commenting on the pernicious effect of negative rates and how they are an aberration which cannot and should not be ‘allowed’ to continue. Reality is slightly more nuanced.

To start with, low interest rates are the norm, not the exception throughout history. Second, while indeed a rarity, negative rates have existed in the past, and, depending on circumstances, have lasted longer than initially expected. Third, to ascertain their effect, we must first understand their cause and purpose. All these will eventually allow us to forecast how long they would be around. Still, even then, we must be cognizant that a switch to higher rates will most likely only happen after the economy has first gone through one or a combination of: social unrest, debt jubilee, large increase in the money supply or natural disaster.

Negative interest rates are a result of past accumulation of surplus capital (and its mirror image, large stock of debt) combined with previous persistently high interest rates on that debt relative to the growth rate of the money supply (new money).

The forces that could push rates structurally higher, therefore, would logically be either a reduction of the surplus capital/debt, or a massive increase in the money supply. As neither of this has happened yet, negative interest rates are effectively the market’s response to this status quo: on a long enough timeframe, they reduce the debt stock and they allow the money supply stock to outpace interest payments on the debt and have some left for economic growth.

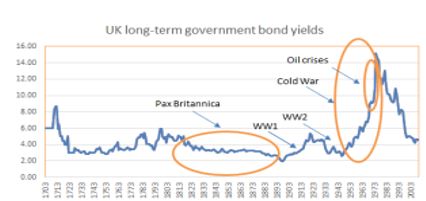

Considering that interest rates measure the cost of capital, when capital is abundant, ceteris paribus, interest rates should be low. For example, normally, periods of peace bring about an accumulation of surplus capital, either directly because money is not spent on wars, but more importantly, indirectly, as people innovate and bring about technological advancements which increase efficiency and reduce the need for more capital in general. As a result, interest rates trend lower. That’s exactly what happened, indeed, during the almost century of peace in the time of Pax Britannica in the 19th century.

Source: BeyondOverton, BOE Three Centuries of Data

At the same time, wars, conflicts, or even big natural disasters, deplete the capital stock and force interest rates to rise. Sometimes, when these negative supply shocks turn out to be ‘one-off’ occurrences (the 1970s oil crises), we could get just a spike in interest rates; sometimes, if the conflict persists, the increase in interest rates can last much longer (the Cold War).

On a long enough timescale, one would then expect to see periods of low interest rates inevitably followed by periods of high interest rates in a kind-of mean reversion pattern. Actually, that is not the case. In fact, according to Paul Schmeizing[1], real rates have been falling for over 500 years on a variety of regression measures:

“…over the entire timeframe 1313-2018, I find 19.7% of advanced economy GDP experience negative long-term real rates on an annual basis…the general trend of an even higher frequency of negative rates is independent of the establishment of central banks and active monetary policy.”

Mean reversion of interest rates is not a given from a historical point of view largely because certain events, the so-called paradigm shifts, have such a profound effect on the production function that no war or natural disaster can easily reverse. For example, the Agricultural Revolution ushered the first large (and ‘permanent’) resource surplus which lasted humanity indeed a long time. We came close to depleting it during the centuries of the Dark Ages in Europe but, with the help from the Renaissance, the Industrial Revolution couldn’t come soon enough to change the paradigm shift once again. After that, Aggregate Supply (AS) had been consistently running above Aggregate Demand (AD).

While on the face of it, an imbalance of this sort, AS > AD, is much better than the reverse, managing it, has proven quite difficult over the years. Especially in the more modern times when the changes affect both the production function and the mode and nature of consumption (from a physical to a digital medium – more on this later).

Feudalism, socialism, capitalism, etc., are all examples of how society is designing an institutional framework to help distribute these surpluses in the most optimal way. However, because of the inertia of the past and the numerous vested interests, such institutional changes may take much longer than the production breakthroughs to feed through. Therefore, as the capital surpluses keep adding up while their distribution mode remains the same, the economy becomes even more imbalanced.

If capital does not flow naturally through the income channel to raise the purchasing power of the majority, aggregate demand starts to lag. Debt becomes then the lever which transfers purchasing power, in a way substituting for rising wages. However, as debt comes with the additional burden of positive interest rates, it pushes up inequality to an unsustainable level thus closing even that avenue of balancing the economy. Therefore, AS continues to increase at the expense of AD, and a deflationary spiral ensues. A temporary solution to this problem in the past has indeed been a form of negative rates, called demurrage money.

Demurrage money is not unusual in history. Early forms of commodity money, like grain and cattle, were indeed subject to decay. Even metallic money, later on, was subject to inherent ‘negative’ interest rates. In the Middle Ages in Europe coins were periodically recoiled and then re-minted at a discount rate (in England, for example, this was done every 6 years, and for every four coins, only three were issued back). Money supply though, did not shrink, as the authorities (the king) would replenish the difference.

In 1906, Silvio Gesell proposed a system of demurrage money which he called Freigeld (free money), effectively placing a stamp on each paper note costing a fraction of the note’s value over a specific time period. During the Great Depression, Gesell’s idea was used in some parts of Europe (the wara and the Worgl) with the demurrage rate of 1% per month.

The idea behind demurrage money is to decouple two of the three attributes of money: store of value vs medium of exchange. These two cannot possibly co-exist and are in constant ‘conflict’ with each other: a medium of exchange needs to circulate to have any value, but a store of value, by default, ‘requires’ money to be kept out of circulation.

Negative interest rates solve this issue by splitting these two functions. The problem though is that negative rates are not a very efficient tool for reducing the capital surplus because the whole process takes a really long time. Absent any other changes in the institutional framework, the general pattern of the past has therefore been for a military conflict, either a revolution or a war, to literally obliterates the capital surplus.

As mentioned before, indeed, the Industrial Revolution was followed by the century of peace of Pax Britannica during which neither low rates nor the gold standard managed to close down the inter-country economic imbalances, thus we got two very violent world wars. The period between the end of WW2 and now is considered one of general world peace. And indeed, relative to the horrors of the war which preceded it, it was.

But despite the fact that there were no major traditional global wars after 1945, the Cold War was a major global war of ideologies, in which few shots were fired, but one which caused a large capital outlay (military build-up, but also huge government investments in space exploration, and in general, technology). In addition, there were a lot of proxy wars (Afghanistan, Korea, Vietnam) and conflicts (for example, the 1970s oil crises were a result of such a proxy conflict). It is not surprising then, that during that time interest rates tended to stay high.

(Incidentally, it is with sadness that I heard of the passing of Paul Volcker the other day, but reality is that he presided over a Fed which orchestrated the largest aberration in the history of interest rates since Babylonian times. In my opinion this was totally unnecessary and a complete overkill.)

Source: Business Insider; original data from ‘History of Interest Rates’ by Homer and Sylla

By the end of the Cold War, when it was clear that capitalism had gained the upper hand as the main institutional framework of the time, interest rates started to subside. It also became obvious that the USA was to become the undisputedly dominant global power. In addition, all these (mostly government) investments of the Cold-War time started to pay off, eventually ushering the Digital Revolution which is still ongoing. To a certain extent, one could think of this period as Pax Americana, in reference to the global dominance of Britain during most of the 19th century.

The Digital Revolution has heralded a similar paradigm shift to the Agriculture and Industrial Revolutions in the past. Indeed, the resulting capital surplus has not only completely reversed the previous spike in interest rates but has brought about a strong disinflationary environment pushing real interest rates in negative territory.

This period is called by some the biggest and longest bond bull market in history. It is probably the biggest because interest rates have gone down from double digits in the 1980s to almost 0% now. But it is certainly not the longest. As seen in the chart on page 1, interest rates in Britain trended down from 6% to 2% for almost 100 years in the 19th century. And it doesn’t yet look like there is an end to this bull market as there are no signs that anything is being done on the institutional side to take into account the changing modes of production and consumption caused by the paradigm shift of the Digital Revolution.

Moreover, low/negative interest rates are only really applicable to the government sovereign market. In the current debt-backed system, the majority of money is still loaned into circulation at a positive interest rate. Even in Europe and Japan, where base interest rates and sovereign bond yields are negative, the majority of private debt still carries a positive interest rate. This structure inherently requires a constantly growing portion of the existing stock of money to be devoted to paying solely interest. Thus, the rate of growth of the money supply has to be equal to or greater to the rate of interest; otherwise more and more money would be devoted to paying interest rather than to economic activity.

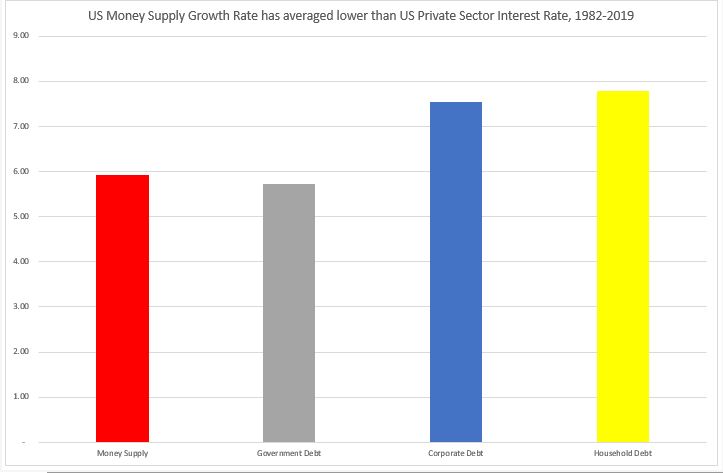

Source: BeyondOverton, US Federal Reserve

This is indeed problematic if one considers that the long-term average growth rate of US money supply in modern times is around 6% (chart above), which is only slightly higher than the average interest rate on US government debt but it is below the average interest rate on both US household and corporate debt. To reach this conclusion, I used the US Treasury 10-year yield as the average yield on US government debt (the average maturity of US debt is slightly less than that), and allowed very generous estimates for both US corporate debt and household debt[2].

In addition, I have not included the much higher yield on US corporate junk bonds which comprise a growing proportion of overall corporate debt now. I have not used either credit card/consumer debt, which has a much higher interest rate, or student loan debt, which carries approximately similar interest rate to auto loans rates used in the calculation. Just like for BBB and lower rated US corporates, credit card and student loan debt are a much higher proportion of total US household indebtedness now compared to before the 2008 crisis.

Finally, I estimated the long-term average economy-wide interest rate as a weighted average of government, corporate and household debt – with the weights being their portions of the total stock of debt. With the caveats mentioned above, that average rate since the early 1980s is about 7% – higher than the average money supply growth rate.

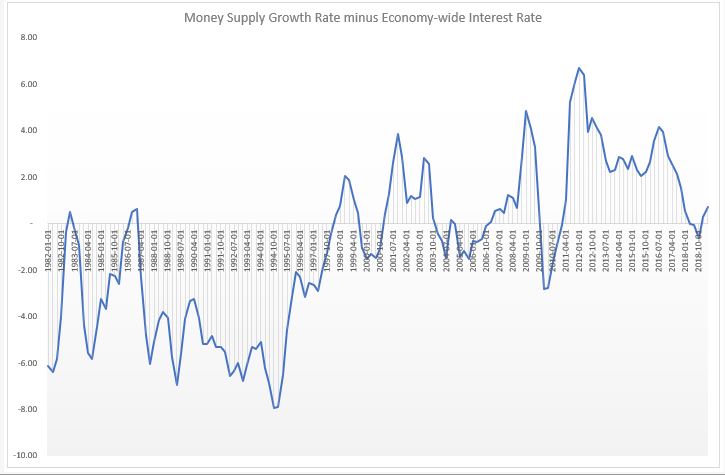

Source: BeyondOverton

Over the last four decades, US money supply has not only not grown enough, on average, to stimulate US economic growth, but has been, in fact, even below the overall interest rate of the economy. Needless to say, this is not an environment that can last for a long time. It is surprising it did go on for so long.

Indeed, if one calculates the above equivalent rates for the period 1980-2007 only, the situation would be even more extreme (see chart above). In fact, until the late 1990s, money supply growth had been pretty much consistently below the economy-wide interest rate. Only after the dotcom crisis, but really after the 2008 crisis, money supply growth rate picked up and stayed on average above the economy-wide interest rate.

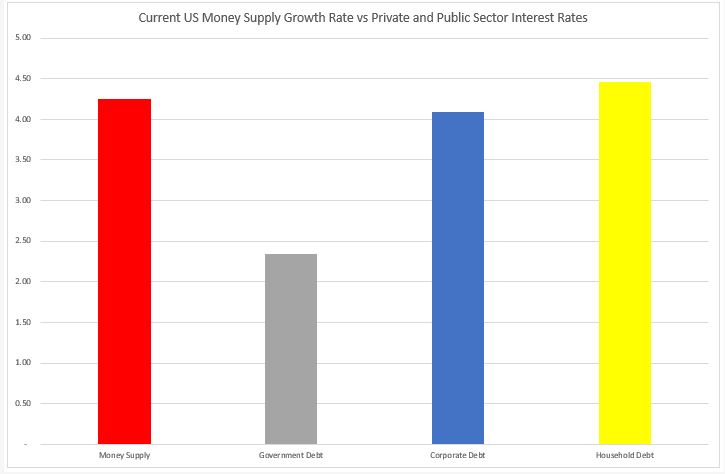

What is the situation now? The current money supply growth rate is just above the average economy-wide interest rate: above the government and corporate interest rates but below the household interest rate (data is as of Q1’2019, chart below). It is also still below the combined average private sector interest rate.

Source: BeyondOverton

So, even at these low interest rate, US money supply is just about ‘enough’ to cover interest payments on previously created money. And that is assuming equal distribution of money. Reality is that new money creation is only just ‘enough’ to cover interest payment on public debt. Moreover, money distribution is very skewed in the private sector: corporates have record amount of cash but that cash normally sits only in the treasuries of few corporates. The private sector, overall, can barely cover its interest payment, let alone invest in CAPEX, etc.

Seen from this angle, negative interest rates may not be a temporary phenomenon designed just to spur lending. On the opposite. It is almost counter-intuitive from what we learn in economics where we are accustomed to think that a rising GDP is associated with higher interest rates because of the need to suppress potentially inflationary pressures. Reality is that a rising GDP also produces more excess capital which tends to naturally put pressure on interest rates lower. If this increase in AS is not fully offset by a rise in AD, inflationary pressures may not develop and interest rates may not rise. In fact, they may start falling if the debt build-up becomes excessive. In that regard, the purpose of negative interest rates may be to help reduce the overall debt stock in the economy and to escape the deflationary liquidity trap caused by the declining marginal efficiency of capital.

Could they work? Sure, they could, but unless they are deeply negative, it will take a really long time and, most likely, the fabric of society would come apart either way. So, what could cause this massive bull market in rates then to reverse?

Well, it is unlikely to see those signs of reversal in any economic variable on the demand side, like lower unemployment or even higher wages, as the surpluses are just too large. At least not from a structural point of view: for example, a pop in real wages could see a pop in real rates but that will quickly reverse as the supply side will adjust almost ‘instantaneously’. Instead, we should look for signs of any pressure on AS which would come about from institutional changes. Anything that suddenly reduces the capital/debt surplus, such as a debt jubilee, or permanent increases of the money supply, such as ‘helicopter money’.

In the absence of such changes, we could either see a prolonged period of negative interest rates to address the above imbalances or, in the worst-case scenario, for example in the US where there is strong institutional pushback against them, social unrest. The process of de-globalization, which started already with Brexit and Trump’s US tariffs, is another supply side force which would take its time but could eventually erode the global resource surplus.

In the end, if all else fails, nature would have the final say as climate change could cause a massive natural disaster, leading to such a destruction of capital, that interest rates would be bound to go much higher from there!

[1] Eight Centuries of Global Real Interest Rates, R-G, and the ‘Suprasecular’ Decline, 1311-2018, 24 Nov. 2019

[2] For corporate debt I used the average yield on Aaa and Baa bonds and for household debt I used mortgage debt and auto loans