Tags

It has been going on now for a year, at least: after stopping Chinese companies on several occasions from buying specific US assets, the US administration has been also looking into banning outward US investments in Chinese assets.

The fund in the spotlight is the Federal Government Thrift Savings Plan Fund (TSPF) – the largest defined contribution plan in the world with assets of about $558Bn. The assets are split in five core funds and one additional overlapping fund as following:

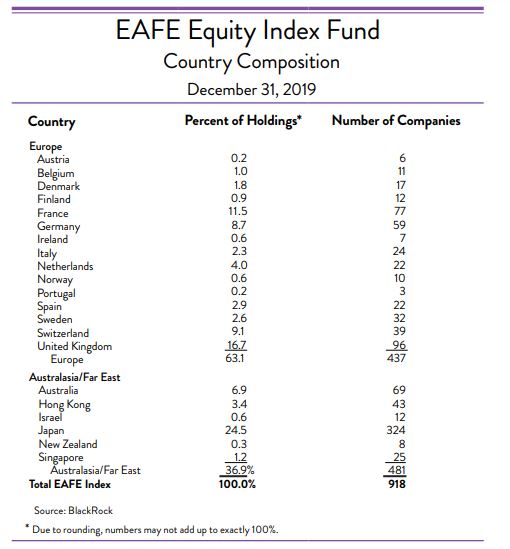

Of those above, it is the I Fund that is now in the spotlight. For the moment, it has no exposure to China as it is invested in MSCI ex US EAFE.

TSPF is an outlier amongst most large retirement plans that it still has no EM exposure. In June 2017, external consultants, Aon Hewitt, made a recommendation to the board to switch to MSCI ex US All Country which is a much broader index followed by all large retirement plans. One characteristic of this index is that it includes many EMs (and yes China). The board studied the proposal and made the decision to switch in November 2017 with a target for that sometime in 2019*.

As the US-China trade war was going in full swing, the threats of possible ramifications on US investments in China started coming in, and the I Fund never made that switch.

How big is this potential US investment?

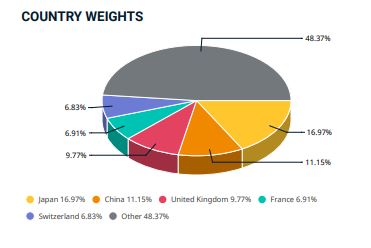

The MSCI ex US All Country is still about 75% developed markets (DM). But China is about 11% weight (second largest now), which is rather big given the recent index inclusion (the weightings have increased progressively in the last two years). That means the I Fund would have between $6Bn exposure to Chinese equities.

Adding the L Fund exposure. The L Fund will have 9% in the I Fund (from 8% currently). Therefore, given the AUMs in each above, it will have between $1-2Bn Chinese equities exposure. So, total TSPF exposure will be max $8Bn. Note, however, the L Fund’s expected exposure going forward: projections are for a substantial reduction in the G Fund weights at the expense of all others. So, potentially the future Chinese exposure can grow substantially as also China’s weight in the MSCI ex US All Country index also grows.

What is that in the context of the big flow picture?

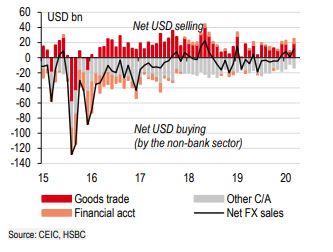

China is in the cross hairs of deglobalization which started before the Covid crisis, but now, that process is accelerating in direct proportion to the anger towards China amongst some of the major global players, especially the USA. In the USA, globalization coincided with financialization which promoted major capital inflows to offset the trade account outflows. Financialization is now on the wane in the USA (as per the regulations post 2008, and accelerated further post the Covid crisis), while on the rise in China (see flows below).

As the Chinese economy has been catching up to the US (and possibly the Covid crisis also accelerated this process as well), it is likely that we may see a reversal of some of these past flows, namely, a reduction in China’s current account surplus at the expense of net foreign inflows.

Equities

- Last year passive index inflows in China A shares were $14Bn; total inflows were about $34Bn

- Total foreign investment in Chinese A shares is about $284bn

- Foreign equity inflows this year are still a positive $5Bn despite the Covid crisis: according to HSBC data, March recorded an outflow (largest ever) but all other months were inflows, with April inflow more or less cancelling the March outflow.

Fixed Income

- Total foreign holdings are also around $283Bn, 70% of which are in GGBs.

- Inflows into GGBs have been consistently positive since the index inclusion announcements last year and the year before.

- According to Barclays, YTD net Inflows are at $17Bn (5x more than at same time last year) despite a net outflow in March (but that was only because of selling in NCDs).

- Average monthly inflows in Chinese FI is about twice that in equities.

Domestic Flows

- March registered the largest domestic outflow ($35Bn) of any month since the 2016 CNY crisis (largely due to southbound stock connect flow (mainland residents bought the largest amount of HK stocks on record).

- According to HSBC, FX settlement data shows that, most likely, domestic corporates have actually been net sellers of foreign currency in Q1 this year.

Economics

While Chinese exports are expected to decline going forward, in the short term, so are imports, especially after the collapse in oil prices. However, it is inevitable that if globalization does indeed start reversing, China’s current account will shrink and possibly go into a deficit.

Conclusion

What happens to the overall flow dynamics then, really depends on whether foreigners continue to invest in Chinese assets (and expecting that domestic residents might look to diversify their portfolios abroad once the capital account is fully liberalized, if ever). A potential ban on US Federal Government investments in China might indeed be driven by short-term considerations and emotions following the Covid-19 pandemic developments, however, unless it is followed by also a ban encompassing all US private investment, it is unlikely to amount to anything positive for the US. Moreover, it could actually give the wrong signal to foreign investments in the US, that the administration is becoming not so ‘friendly’. That could spur an outflow of foreign money from US assets, something that I discussed at length here.

*See the memo from that meeting here: https://www.frtib.gov/MeetingMinutes/2017/2017Nov.pdf