Tags

“General Motors Corp. filed for bankruptcy protection, got kicked off the New York Stock Exchange and out of the Dow Jones industrial average. And its stock has mostly been rising ever since. In fact, GM has been one of the hottest issues on Wall Street over the last six trading sessions, surging from 61 cents totoday’s closing price of $1.59 in the electronic pinksheets.com market – a gain of 161%. (…) As I’ve written before, there’s a universe of traders out there who love to play around with big-name stocks that end up in bankruptcy. You can’t explain the action based on any fundamentals. It’s just a minute-to-minute, hour-to-hour trading game. (…) We know how this will end. But between now and then, for some gamblers playing GM is better than a trip to Vegas.”

“GM’s stock keeps trading but it is probably worthless” Tom Petruno, Los Angeles Times, June 10, 2009

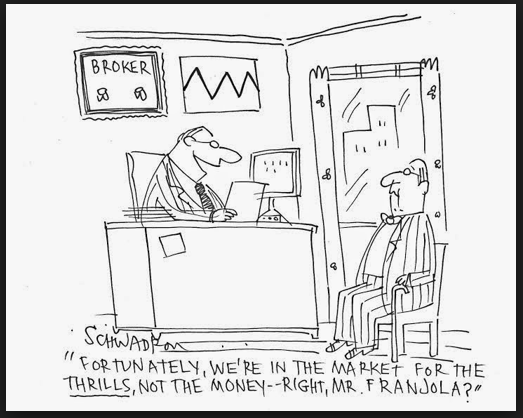

The price action in Hertz shares post-bankruptcy is quite normal (up to “Bankrupt Hertz granted approval to sell up to $1Bn in shares”, but that is another, important, story). The elevated activity of retail investors in trading the shares of bankrupt companies is a feature of this particular market. For a lot of them it ends badly, but most of them are doing it for the fun of gambling anyway.

I am not a bankruptcy expert or a bankruptcy lawyer and I have never been involved in a company restructuring (plenty of bond restructurings though). Let’s say that before Hertz, I knew nothing about bankruptcies. What I found fascinating with that recent episode, though, is that even people who should know about corporate bankruptcy (equity portfolio managers) did not know much either. I was intrigued by the Hertz case as it looked quite bizarre and indeed the price action seemed against all common sense.

As I embarked on researching the topic, it turned out that even the academic literature on this is quite scarce. Of course, there is a lot that addresses bankruptcy cases and issues but there is little on trading, valuations or performance of stocks which have entered bankruptcy. There are a few reasons for this perhaps. First, most bankrupt stocks are delisted from major exchanges before or around bankruptcy filings. Second, institutional ownership declines massively post-bankruptcy, with 90% of shares owned by retail thereafter. Third, research coverage drops as a result. And fourth, yes, the market for bankruptcy shares, it turns out, is quite inefficient, for example, very difficult to short (inability to source borrowing) and very wide bid-offer spread (all due to thin institutional involvement).

To do my research I relied extensively on two papers: 1. “Investing on Chapter 11 stocks: Trading, value, and performance” by Yuanzhi Li and Zhaodong Zhong 2. “Gambling on the market: who buys the stock of bankrupt companies?” by Luis Coelho and Richard Taffler. The below is my summary of some of the topics discussed in these as they pertain to markets.

There are quite a few misunderstandings about bankruptcy procedure. First, when companies get delisted, they don’t just disappear but continue to trade on the Pink Sheets, which is an electronic quotation system. Second, even though there are quite a few limitations, as mentioned above, trading activity is quite brisk. Third, it is quite common for prices to bounce immediately after bankruptcy announcements as institutional shareholders tend to choose to cover their shorts on the major exchanges than go through the Pink Sheets or indeed through the bankruptcy proceedings. Fourth, although in the majority of cases shareholders do get zero, there are precedents where shareholders gain, sometimes substantially, when buying the stocks immediately after bankruptcy announcements.

So, the fact that Hertz share price rose in these circumstances should not be a surprise given that the company was one of the most shorted stocks on the main exchanges for a number of years before. Moreover, it is quite common for share prices to rise immediately after declaring bankruptcy, even independent of short covering, on the back of a phenomenon called violation of APR (absolute priority rule) which occurs “when creditors are not fully satisfied before shareholders get any payments”.

There are two main reasons to do that. One is rational: there is value in buying cheap and deep out of the money call options on a company’s assets, operations, brand, etc. (some of them, some of the time, will pay off handsomely). There are examples of companies exiting bankruptcy with the original shareholders having gained from owning the shares from the day bankruptcy was officially announced.

The second reason is irrational. There is a massive non-linearity in the return: you get either zero or a lot. And who doesn’t like a cheap lottery ticket! The average price of bankrupt company shares is actually around $2 (yes, Hertz is well within that price range at the moment) in the month immediately post-bankruptcy, which to a lot of retail investors, looks, yes, irrationally, cheap.

“The human propensity to gamble seems to be able, at least partially, to explain why stocks of bankrupt firms continue to be actively traded by retail investor even after the formal announcement of bankruptcy.”

But don’t be deluded. There is only an ‘illusory profit opportunity’. The average return on holding the shares of bankrupt companies into the actual process of restructuring is a negative 28%. Limited possibility of short selling and not enough company disclosure, contributes to share prices reflecting a more optimistic scenario than actual reality and being much higher initially than, perhaps, ‘fundamental value’. That is why, there is a persistence of negative returns from a buy-and-hold strategy in bankrupt company shares: at the end of the bankruptcy proceedings, the true value of the stock is revealed. That does not mean though that buyers can not make money buying and selling the stock while still in the Pink Sheets.

Trading in the stocks of bankrupt companies whether immediately post-bankruptcy, as with Hertz, or in the Pink Sheets, is much more ‘suitable’ for retail investors, who, unlike institutional investors are more prone to overvalue risky assets and to prefer lottery-like payoffs. The current stock market activity, in general, was dominated by retail investors even before Hertz to an extent last observed probably during the dotcom boom. So, perhaps we are focusing too much on this phenomenon, and, in the process, exaggerating the effect retail investors have on the market, away from what that normally is.